If you look at the ‘graph’ Network Profit and Loss Statement (which is actually a table), you will see that the model so far reports no interest expense, tax or dividends. This is a deliberate simplification, and reflects the fact that many projects focus only on the operating results of a business unit within a larger corporation.

However, if you are looking at a new or separate venture, then it is critical to consider the overhead of actually funding the business.

Save the model as WiMAX-DSL45

Save the model as WiMAX-DSL45

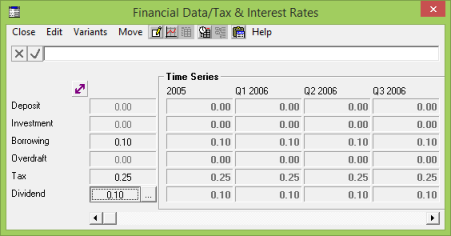

- Set the inputs Borrowing Rate = 0.1 (10%), Tax Rate = 0.25 (25%) and Dividend Rate = 0.1 (10%) (Data menu/Financial Data/Tax & Interest Rates).

Save and run the model

Save and run the model

- Draw the graphs, Network Long-Term Borrowing and Network Interest Expense and Income.

Is the interest correct? What is the effective interest rate per quarter?

Is this as much borrowing as you would expect?

- Draw the graph Network Share Capital and Retained Earnings.

You can see that the business is raising share capital until its retained earnings turn around (i.e., retained profit goes positive). Why is borrowing so much smaller than the share capital?

- Draw the graph Network Long-Term Assets.

A business can borrow against fixed assets, but not against operating costs.

Tax charge, tax payable and tax paid

-

Draw the graph Network Tax. (You may find it helpful to show this graph as a separate table.)

You will see that Tax Charge is calculated as the prescribed percentage of Pre-Tax profit, but that it is not paid immediately. One result, Tax Payable, accumulates tax owed during one financial year, and then Tax Paid shows when this is paid – by default, at the end of the next financial year. Net Profit is Pre-Tax Profit minus Tax Charge.

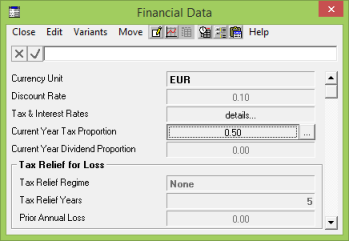

The Current Year Tax Proportion input controls how much Tax Payable is actually paid at the end of the financial year in which it is generated, as opposed to the end of the following year (Data menu/Financial Data).

-

Measure the impact of changing this proportion to 0.5.

In this model, Pre-Tax profit is the same as Taxable Profit. In general, the Taxable Profit may be reduced through tax relief for previous losses. Exploring this mechanism in detail is beyond the scope of this training course, but please press <F1> in the Financial Data dialog to learn about the options.

- See what happens to the Taxable Profit result if you select Tax Relief Regime = Unlimited.

Dividends declared, dividends payable and dividends paid

- Draw the graph Network Dividends.

You will see that Dividends Declared is calculated as the prescribed percentage of Net Profit, but that it is not paid immediately. One result, Dividends Payable, accumulates dividends declared during one financial year, and then Dividends Paid shows when this is paid – by default, at the end of the next financial year. Retained Profit is Net Profit minus Dividends Declared.

The Current Year Dividend Proportion input controls how much Dividends Payable is actually paid at the end of the financial year in which it is generated, as opposed to the end of the following year.

- Measure the impact of changing this proportion to 1.0.

- Returning to the graph Network Share Capital and Retained Earnings, you should see that Retained Earnings breaks even a little before 2013.

- Set the various Tax and Interest rates back to zero and see which has the most impact.

Remember that Retained Earnings is a cumulative result, so the business will be paying tax (and potentially dividends too) before this is positive!

There is a built-in function, breakEven(), which can be used to report when a cumulative result ‘crosses the axis’.

- Draw the ‘graph’ Network Financial Indicators (actually a table).

This reports that Long-Term Borrowing returns to zero after 4.25 years, whereas NPV (Zero Terminal Value) takes over 8.5 years to go positive.

- Save the results workspace before continuing.

Things that you should have seen and understood

Things that you should have seen and understood

Long-term borrowing, interest, tax, tax relief for loss, dividends, break even

Tax and Interest Rates, Current Year Tax / Dividend Proportion, Tax Relief for Loss

Payback for Long-Term Borrowing, Break-Even Point (ZTV)