Each Resource has a Physical Lifetime and, optionally, a distinct Financial Lifetime, not greater than its Physical Lifetime. The Physical Lifetime of a Resource controls the frequency with which it is replaced, while the Financial Lifetime sets the period over which its asset value is written off. If no Financial Lifetime is set for a Resource – i.e., its default remains at 0 – then the financial life is the same as its physical life. The asset value is the Capital Expenditure for the Resource.

The Historical Cost result is the gross book value of fixed assets, i.e., the total original value of the Resources still installed in the network, before depreciation.

If only a Physical Lifetime is specified, then the capital cost of that Resource will be written off over the period that the Resource is in the model and the final write-off will coincide with its removal from the model. If the Resource is given a Financial Lifetime, then the depreciation of the Resource will be over the specified Financial Lifetime. In other words, the Resource may remain in the model until the end of its Physical Lifetime, but with no further asset value. However, it will continue to generate costs.

Tangible

By default, Resources are classified as Tangible for accounting purposes. However it is usual to talk about Amortisation rather than Depreciation for certain types of Resource, such as a capitalised licence fee, and this distinction is achieved by setting the input Tangible =

No

for such a Resource. This input also governs the corresponding aggregation of Net Fixed Assets for individual Resources to calculate network results for Net Tangible Assets and Net Intangible Assets.

Depreciation rate

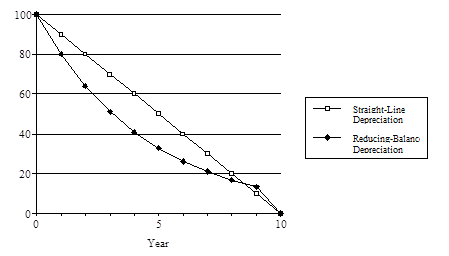

The default of –1 is a special value which specifies straight-line depreciation. In other words, the value of the Resource depreciates in equal amounts each year over its Physical Lifetime. For example, a Resource that costs 100 currency units to purchase and install and has a Financial Lifetime of ten years, will be worth 90 currency units after one year, 80 currency units after two years and nothing after ten years.

Any other value is interpreted as a proportion for reducing-balance depreciation, whereby depreciation is charged at a fixed proportion of the remaining written-down value. For example, if the rate is set at 0.2, representing 20% per annum, the Resource would be worth 80 currency units after one year, 64 currency units after two years and so on, until any residual value is written off at the end of its financial lifetime.

Straight-Line and Reducing-Balance Depreciation

Early decommissioning

If a Resource is removed from the network before the end of its Financial Lifetime due to Redundant Unit Decommissioning, the residual value of the Resource is written off when it leaves the network.

Note: The decommissioning age factor applies relative to when the resource comes to the end of its physical life. This differs from the other age factors, which apply relative to the start of the resource's acquisition. See 10.3.7 Cost Trends and Age Factors.