The demand for a shorter time period model has grown in recent years, both as modelling techniques have improved and as the demand for short-term business plans has increased. The appeal of greater chronological detail is clear and universal, and is spelled out below. However, the technical challenge was to provide this detail as an optional extra rather than as an intimidating pre-requisite for constructing all models.

Objective

The goal was to develop an investment model which:

-

performs more detailed business analyses

-

projects the timing of revenues and investments with greater precision

-

calculates results with pertinent accuracy and realism, especially when assessing the business case for a new operator or service (annual models tend to overstate costs and revenues when demand increases rapidly).

Scope

In order to realise the objective of a shorter time period model, we first had to identify key specific requirements which could be realised within a reasonable time frame.

After some consultation, we established that the new system should:

-

allow inputs to be specified for sub-annual periods or to change on specific dates

-

provide the facility to perform calculations more than once a year, but not necessarily throughout; e.g., running a model for two years in quarters, and thereafter in years

-

produce both ‘raw’ results, for the requested range of months, quarters and years, and also ‘consolidated’ annual results.

Focus

As soon as we began to contemplate the design of calculations in a sub-annual context, it became clear that we would have to choose between a top-down approach – where months and quarters are viewed as sub-divisions of a year – and a bottom-up approach – where years are viewed as the aggregate of variable monthly periods. On the basis that:

-

the impact of whether a given investment falls in Q2 or Q4 may be of vital significance

-

we are generally less concerned about minor fluctuations in revenue due to the varying number of days in a month or the occurrence of a leap year

-

it would be prohibitively complicated to wrestle with constant ambiguity as to whether annual inputs are interpreted, e.g., as a calendar-year multiplier or as a cost per 365 days (or should that be 366…),

we concluded that the top-down approach was much more appropriate for a strategic investment model. Thus years remain the primary measure of time, with quarters and months viewed as sub-ordinate divisions.

Idealised calendar

In order to reflect this annual focus, model inputs, calculations and results are interpreted, performed and generated in the context of a homogeneous, idealised calendar where:

- all months have 30 days

- all quarters have 90 days

- all years have 360 days.

Real dates are mapped into this calendar at face value, with the caveat that, e.g., 31 Dec → 30 Dec.

Nesting and consolidation

Idealised months and quarters form neat, nesting sub-divisions of a year which can be consolidated readily:

-

one year is equivalent to four quarters

-

one quarter is equivalent to three months.

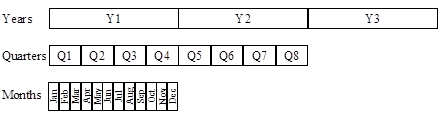

Nesting Years, Quarters and Months

Weeks are conspicuous by their absence from this formalism; but they don’t nest within months, or even years, so it would be difficult to consolidate weekly results. Furthermore, week numbering can be controversial, so there would be significant scope for confusion and misalignment of weekly inputs.

From a pragmatic viewpoint, a modeller will be hard-pressed dealing with monthly data, let alone 52 or 53 columns of data per year!

Run period

The time frame for a model is specified as:

-

a Model Start Date, which can be either a year (implying 1 Jan), or a fully qualified date if you want to model in financial years, e.g., from 5 Apr 2001

-

a Model Run Length, measured in years from the Model Start Date

-

an Include Year Zero flag, which governs the inclusion of a base or reference period immediately preceding the Model Start Date.

Although the new model can process any arbitrary series of periods, the current interface restricts shorter time periods to:

-

a number of initial Years in Quarters

-

a number of initial Quarters in Months

commencing from the Model Start Date. Shorter time periods are not available for year zero because this is now designed and reserved as a base or reference period.

See also 10.3.20.1 Understanding the Run Period.